Accessory Dwellings

A one-stop source about accessory dwelling units, multigenerational homes, laneway houses, ADUs, granny flats, in-law units…

Breaking Bad is over. It’s Time to Break Even.

Cooking meth is apparently one way to make money fast. But, for many of us, this option is far less appealing now that we’ve finished watching Breaking Bad. After the turmoil of those five gripping seasons of television, I’ve come full circle back to the idea that building an ADU on my property was a better way to build income.

Walter White contemplating whether he should have just built an attached ADU instead of cooking meth

I’m not alone. According to the recently completed ADU survey conducted in Oregon, 51% of homeowners who built ADUs were motivated primarily by the rental income potential.

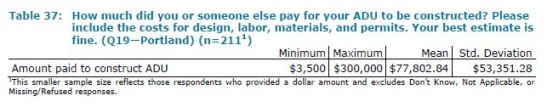

The average monthly rental income for ADUs in Portland is $812/month and the average cost to construct an ADU in Portland is $77,802.

Based on these averages, it takes 8 years of ADU rental income to breakeven — eight years to make back what was invested in the cost of ADU construction.

But, this does not account for rent inflation, property tax increases, nor the interest that was charged to a homeowner for a loan they may have used to pay for construction.

It also does not consider the increasingly common scenario of homeowners who build an ADU to live in it as their primary residence and rent out their main house for rental income instead. Not surprisingly, if the main house rents for more than the ADU, the homeowner can breakeven on their investment more quickly.

Calculating the breakeven period for an ADU is complicated. This is why I was excited when Lisa Vermillion decided to build an ADU Breakeven Calculator as her MBA project.

From Lisa: As an MBA student at Marylhurst University, I studied the the costs and benefits of ADUs. After discussing my research with Kol, I began developing a tool that I hoped people could use to help them consider their circumstances when making the decision to add and ADU to their property. Kol and I worked together to find a balance between usability and usefulness when develop this calculator. It works based on your inputs and assumptions, as well as some assumptions built into the calculator, and therefor is not guaranteed, intended as an investment tool, or as investment advice. It is my hope that it will help you explore ADU feasibility in the context of your own circumstances and give you a better sense of the costs and benefits.

This calculator is a way to numerically illustrate the timeline to breakeven for ADU construction. The breakeven is given as a straight integer in years, rounded down. For example, if the breakeven time is actually 6.4 years, the calculator will display that as 6 years.

This calculator is not intended to provide investment advice since there are numerous life factors to consider for any large financial investment. It does not take into account current property value, current mortgage payoff, maintenance costs, utility bills. And, it certainly does not account for the less easily quantifiable benefits that ADUs provide. Nonetheless, it is a very helpful tool for homeowners who are considering building an ADU.

If you have comments or questions about the calculator, write them as a comment. You download the full version of the calculator here.

If only Walter White had access to the ADU Breakeven Calculator, Breaking Bad could have turned out so differently.

This is a great blog, thanks for publishing. Does this financial evaluation take into account depreciation & the tax benefits thereof? That’s a major source of “income” for landlords, typically, and would also provide a big boost to investment returns.

Thanks for your comment.

The author of the spreadsheet wrote “No because it is very complicated and I wanted to keep this spreadsheet simple. But the commenter should definitely consider tax implications. I don’t know much about calculating for depreciation. Probably a question for a real estate investor.”

Thanks, Kol- Editor